Kompally continues to hold its ground as a north-western Hyderabad micro-market catering primarily to mid-segment and resale-driven demand. While it lacks the momentum of high-rise-driven western corridors, its affordability, rental stability, and access to the ORR keep it relevant—particularly for end-users seeking larger configurations within a ₹1.2–1.5 Cr bracket. April 2025 saw a slight uptick in average prices alongside a marginal dip in resale share, signaling a gradual evolution in buyer mix.

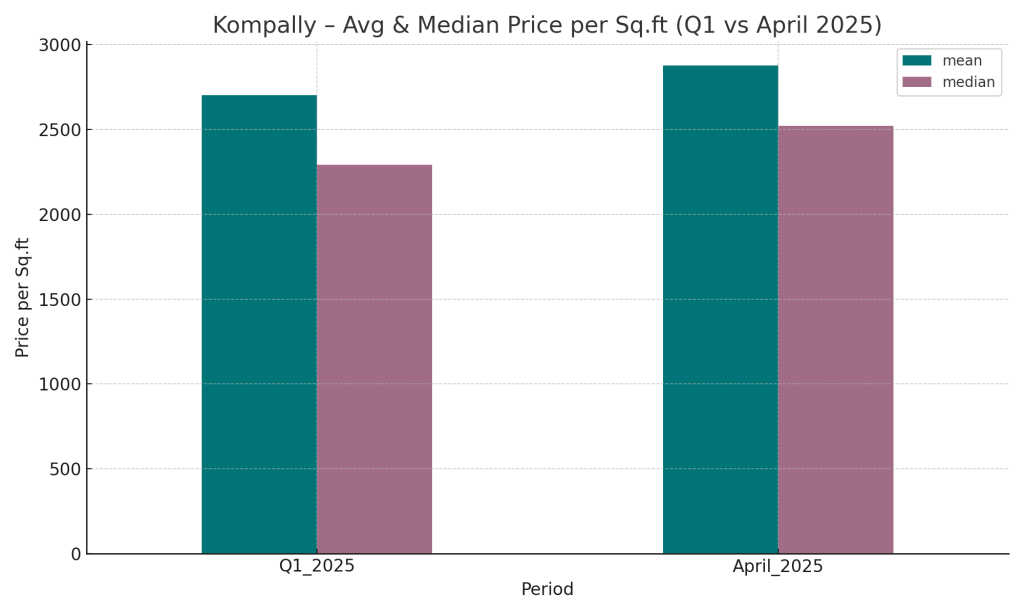

Market Snapshot – Kompally (Q1 vs April 2025)

| Metric | Q1 2025 | April 2025 |

| Average Price (per sq.ft) | ₹4,361 | ₹4,502 |

| Median Price (per sq.ft) | ₹3,861 | ₹4,107 |

| Total Transactions | 217 units | 92 units |

| Resale Share | ~64.5% | ~59.8% |

| Average Unit Size | ~1,451 sq.ft | ~1,482 sq.ft |

Note: These prices are based on registered transaction data. On-ground market prices, particularly for newer gated communities, may trend higher—₹5,000 to ₹6,000 per sq.ft depending on location and builder profile.

Infrastructure & Growth Drivers

Kompally is evolving into a key mid-segment residential cluster in North Hyderabad, aided by infrastructure upgrades and spillover from nearby industrial and logistics hubs. The area has benefited from improved roads, better access to NH44, and residential activity in adjacent belts like Gundlapochampally and Medchal.

Exclusive Research. Structured Access.

To preserve quality and purpose,

AIQYA’s research is shared by request.